Wells Fargo

|

|

| Type | Public (NYSE: WFC) |

|---|---|

| Industry | Banking Financial services |

| Founded | San Francisco (1852) |

| Headquarters | San Francisco, California, USA |

| Area served | Worldwide |

| Key people | John G. Stumpf (Chairman, President & CEO) |

| Products | Retail banking Investment banking Commercial banking Mortgages Consumer finance Insurance Payday advance |

| Revenue | |

| Profit | |

| Total assets | $1.243 trillion (2009)[1] |

| Total equity | |

| Employees | 267,300 (2009)[1] |

| Website | WellsFargo.com |

Wells Fargo & Co. is a diversified financial services company with operations around the world. Wells Fargo is the fourth largest bank in the US by assets and the third largest bank by market cap.[2] Wells Fargo is the second largest bank in deposits, home mortgage servicing, and debit card. In 2007 it was the only bank in the United States to be rated AAA by S&P,[3] though its rating has since been lowered to AA-[4] in light of the financial crisis of 2007–2010.

Headquartered in San Francisco, California, Charlotte, North Carolina will be the headquarters for the company's East Coast banking operations, (its bank, Wells Fargo Bank, N.A., is legally chartered in Sioux Falls, South Dakota), Wells Fargo is a result of an acquisition of California-based Wells Fargo & Co. by Minneapolis-based Norwest Corporation in 1998. The new company chose to keep the name Wells Fargo, to capitalize on the 150-year history of the nationally-recognized Wells Fargo name and its trademark stagecoach. After the merger, the company maintained its headquarters in San Francisco and charter in Sioux Falls.

As of 2009, Wells Fargo has 6,650 retail branches (called stores by Wells Fargo), 12,260 automated teller machines, 276,000 employees and over 48 million customers.[5] Wells Fargo currently operates stores and ATMs under the Wells Fargo and Wachovia names. As of March 20, 2010 Wachovia Dealer Services became Wells Fargo Dealer Services. As of January 2010, Wells Fargo Phone Bank and Wachovia Direct Access became Wells Fargo Customer Connection including the National Business Banking Center and Credit Card Customer Service.

Wells Fargo is one of the Big Four banks of the United States with Bank of America, Citigroup and JP Morgan Chase.[6][7][8][9][10][11][12]

Contents |

Lines of business

Wells Fargo offers a range of financial services in over 80 different business lines.[13] Wells Fargo delineates three different business segments when reporting results: Community Banking, Wholesale Banking, and Wealth, Brokerage and Retirement.

Community banking

The Community Banking segment includes Regional Banking, Diversified Products and the Consumer Deposits groups, as well as Wells Fargo Customer Connection (formerly Wells Fargo Phone Bank and Wachovia Direct Access).

Wells Fargo also has around 9,400 stand alone mortgage branches throughout the country. It also does mortgage wholesale lending through independent mortgage brokers.

Wealth, brokerage, and retirement

Wells Fargo offers investment products through its subsidiaries, Wells Fargo Investments, LLC and Wells Fargo Advisors, as well as through national broker/dealer firms. Mutual funds are offered under the Wells Fargo Advantage Funds brand name. The company also serves high net worth individuals through its private bank and family wealth group.

Internet services

Wells Fargo launched its personal computer banking service in 1989 and was the first bank to introduce access to banking accounts on the web in May 1995.

Wells Fargo's Business Online Banking gives small business owners all the services available to consumers, plus services designed specifically for businesses.

The new Wells Fargo vSafe service offers online storage of documents.

Wholesale

The Wholesale Banking segment contains products sold to large and middle market commercial companies, as well as to consumers on a wholesale basis. This includes lending, treasury management, mutual funds, asset-based lending, commercial real estate,corporate and institutional trust services, and investment banking through Wells Fargo Securities. The company also owns Barington Associates, a middle market investment bank. Wells Fargo historically has avoided large corporate loans as stand-alone products, instead requiring that borrowers purchase other products along with loans—which the bank sees as a loss leader. One area that is very profitable to Wells, however, is asset-based lending: lending to large companies using assets as collateral that are not normally used in other loans. This can be compared to subprime lending, but on a corporate level. The main business unit associated with this activity is Wells Fargo Capital Finance. Wells Fargo also owns Eastdil Secured, which is described as a "real estate investment bank" but is essentially one of the largest commercial real estate brokers for very large transactions (such as the purchase and sale of large Class-A office buildings in central business districts throughout the United States).

Business model

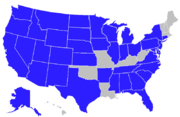

A map of states and cities where Wells Fargo operates retail banks under the Wells Fargo and Wachovia names

The present business model of Wells Fargo is summed up in its vision statement: "We want to satisfy all of our customers' financial needs, help them succeed financially, be the premier provider of financial services in every one of our markets, and be known as one of America's great companies."[14]

Wells Fargo's goal is to encourage its customers to buy all their financial products through Wells Fargo: "We want to earn 100 percent of our customers' business. The more products customers have with Wells Fargo the better deal they get, the more loyal they are, and the longer they stay with the company, improving retention. Eighty percent of our revenue growth comes from selling more products to existing customers. Our goal: sell at least eight products to every customer."[15]

This is a concept known as "cross-selling," or as Wells Fargo refers to it, "needs-based selling," which is popular in the financial services industry. While earlier companies, such as Prudential, pioneered the concept of selling a variety of products, they acted merely as holding companies and each product was sold through its own distribution channel. However, predecessor Norwest pioneered selling all its products through all its channels, with discounts given to those who purchase a larger variety.

The average "cross-sell ratio" for a financial institution is two (based on an average American consumer owning sixteen different financial products from eight different institutions). Wells Fargo stated they had a cross-sell ratio of 5.5 (2007 data) products per Community Banking household (almost one in five have more than eight), 6.1 (2007 data) for Wholesale Banking customers, and the average middle-market commercial banking customer has more than seven products, which is among the highest in the country.[16]

Global presence

Wells Fargo provides comprehensive personal banking services throughout the world. With Main Office in Hong Kong & London[17]

Wells Fargo has a presence in India as well. Wells Fargo India Solutions (WFIS) is a wholly owned subsidiary of Wells Fargo. WFIS is an extended arm of the organization created to support the needs for expansion in technology and business processes. Set up in September 2006 in Hyderabad, India, it is already operating out of two facilities in the city and has people strength of over 1500. Its two Offices are located at Raheja MindSpace, Hitech City, and Divyashree, Raidurg respectively.

History

The current Wells Fargo is a result of a 1998 merger between Minneapolis-based Norwest Corporation and the original Wells Fargo.[18] Although Norwest was the nominal survivor, the new company kept the Wells Fargo name to capitalize on the long history of the nationally-recognized Wells Fargo name and its trademark stagecoach (the company's slogan, "The Next Stage," is a nod to the company's wagons-west motif). After the acquisition, the parent company moved its headquarters to San Francisco.

In-store branches

There are many mini branches located inside of other buildings, which are almost exclusively grocery stores, that usually contain ATMs, basic teller services, and, space permitting, an office for private meetings with customers.[19]

Wachovia acquisition superseding plans by Citigroup

On October 3, 2008, Wachovia agreed to be bought by Wells Fargo for about $14.8B in an all stock transaction. This news came four days after the FDIC made moves to have Citigroup buy Wachovia for $2.1B. Citigroup protested Wachovia's agreement to sell itself to Wells Fargo and threatened legal action over the matter. However, the deal with Wells Fargo is expected to overwhelmingly win shareholder approval as it values Wachovia at about 7 times what the Citigroup deal valued Wachovia. To further ensure shareholder approval, Wachovia issued Wells Fargo with preferred stock that holds 39.9% of the voting power in the company.[20] On October 4, 2008, a New York state judge issued a temporary injunction blocking the transaction from going forward while the situation was sorted out.[21] Citigroup alleges that they had an exclusivity agreement with Wachovia that barred Wachovia from negotiating with other potential buyers. The injunction was overturned late in the evening on October 5, 2008, by New York state appeals court.[22]

Citigroup and Wells Fargo had entered into negotiations brokered by the FDIC to reach an amicable solution to the impasse. Those negotiations failed, however. Sources say that Citigroup was unwilling to take on more risk than the $42B that would have been the cap under the previous FDIC-backed deal (with the FDIC incurring all losses over $42B). While Citigroup was no longer attempting to block the merger, they indicated they will seek damages of $60B for breach of an alleged exclusivity agreement with Wachovia.[23]

Predecessors

Wells Fargo operates under Charter #1, the first national bank charter issued in the United States. This charter was issued to First National Bank of Philadelphia on June 20, 1863 by the Office of the Comptroller of the Currency. [24] Traditionally, acquiring banks assume the earliest issued charter number. Thus, the first charter passed from First National Bank of Philadelphia to Wells Fargo through one of its many acquisitions.

Selected predecessor companies

- Crocker National Bank

- First Interstate Bancorp

- First National Bank of Philadelphia

- First Security Corporation

- Norwest Corporation

- Wachovia Corporation

2008 financial crisis

On October 28, 2008, Wells Fargo and Company was the recipient of $25B of the Emergency Economic Stabilization Act Federal bail-out in the form of a preferred stock purchase.[25][26] Recent tests by the Federal government revealed that Wells Fargo needs an additional 13.7 billion dollars in order to remain well capitalized if the economy were to deteriorate further under stress test scenarios. On May 11, 2009 Wells Fargo announced an additional stock offering which was completed on May 13, 2009 raising $8.6 billion in capital. The remaining $4.9 billion in capital is planned to be raised through earnings. On Dec. 23, 2009, Wells Fargo redeemed the $25 billion of series D preferred stock issued to the U.S. Treasury under the Troubled Asset Relief Program’s Capital Purchase Program. As part of the redemption of the preferred stock, Wells Fargo also paid accrued dividends of $131.9 million, bringing the total dividends paid to the U.S. Treasury and U.S. taxpayers to $1.441 billion since the preferred stock was issued in October 2008.[27]

Achievements

In 2010, The Barbara Saville Women's Shelter named Wells Fargo "business of the year."[28]

Key dates

- 1852: Henry Wells and William G. Fargo (Mayor of Buffalo, NY from 1862–63 and again from 1864–65), the two founders of American Express, form Wells Fargo & Company to provide express and banking services to California.

- 1860: Wells Fargo gains control of Butterfield Overland Mail Company, leading to operation of the western portion of the Pony Express.

- 1866: 'Grand consolidation' unites Wells Fargo, Holladay, and Overland Mail stage lines under the Wells Fargo name.

- 1904: A.P. Giannini creates the Bank of Italy in San Francisco.

- 1905: Wells Fargo separates its banking and express operations; Wells Fargo's bank is merged with the Nevada National Bank to form the Wells Fargo Nevada National Bank.

- 1918: As a wartime measure, the U.S. government nationalizes Wells Fargo's express franchise into a federal agency known as the U.S. Railway Express Agency (REA). The government takes control of the express company. The bank begins rebuilding but with a focus on commercial markets. After the war, REA is privatized and continues service

- 1923: Wells Fargo Nevada merges with the Union Trust Company to form the Wells Fargo Bank & Union Trust Company.

- 1928: Giannini forms Transamerica Corporation as a holding company for his banking and other interests.

- 1929: Northwest Bancorporation, or Banco, is formed as a banking association.

- 1954: Wells shortens its name to Wells Fargo Bank.

- 1957: Transamerica spins off its banking operations, including 23 banks in 11 western states, as Firstamerica Corporation.

- 1960: Wells Fargo merges with American Trust Company to form the Wells Fargo Bank American Trust Company.

- 1961: Firstamerica changes its name to Western Bancorporation.

- 1962: Wells again shortens its name to Wells Fargo Bank.

- 1968: Wells converts to a federal banking charter, becoming Wells Fargo Bank, N.A.

- 1969: Wells Fargo & Company holding company is formed, with Wells Fargo Bank as its main subsidiary.

- 1981: Western Bancorporation changes its name to First Interstate Bancorp.

- 1982: Banco acquires consumer finance firm Dial Finance which is renamed Norwest Financial Service the following year.

- 1983: Banco is renamed Norwest Corporation.

- 1983: Largest U.S. bank heist to date takes place at a Wells Fargo depot in West Hartford, Connecticut.

- 1986: Wells Fargo acquires Crocker National Corporation from Midland Bank.

- 1987: Wells Fargo acquires the personal trust business of Bank of America.

- 1988: Wells Fargo acquires Barclays Bank of California from Barclays plc.

- 1995: Wells Fargo becomes the first major financial services firm to offer Internet banking.

- 1996: Wells Fargo acquires First Interstate for $17.3 billion.

- 1998: Wells Fargo Bank merges with Norwest Corp. of Minneapolis. Norwest changes its name to Wells Fargo and moves to San Francisco.

- 1999: Wells Fargo Bank merges with National Bank of Alaska

- 2000: Wells Fargo acquires First Security Corporation.

- 2001: Wells Fargo acquires H.D. Vest Financial Services.

- 2007: Wells Fargo acquires CIT Construction.

- 2007: Wells Fargo acquires Placer Sierra Bank.

- 2007: Wells Fargo acquires Greater Bay Bancorp.

- 2008: Wells Fargo acquires United Bancorporation of Wyoming

- 2008: Wells Fargo acquires Century Bank.

- 2008: Wells Fargo acquires Wachovia Corporation.

- 2009: Wells Fargo acquires North Coast Surety Insurance Services

Historical data

Asset & Liability |

Asset/Liability Ratio |

Net Income |

Wells Fargo Bank was the fifth largest bank at the end of 2008 as an individual bank. (Not including subsidiaries)

Environmental record

Wells Fargo ranked #1 among banks and insurance companies – and #13 overall – in Newsweek magazine’s inaugural “Green Rankings” of the country’s 500-largest companies.

So far, Wells Fargo has provided more than $6 billion in financing for environmentally beneficial business opportunities, including supporting 185 commercial-scale solar photovoltaic projects and 27 utility-scale wind projects nationwide. For details, please see Wells Fargo’s Environmental Finance Report.

As a member of Environmental Protection Agency’s Climate Leaders program, Wells Fargo aims to reduce its absolute greenhouse gas emissions from its U.S. operations by 20% below 2008 levels by 2018.

Wells Fargo has launched what it believes to be the first blog among its industry peers to report on its environmental stewardship and to solicit feedback and ideas from its stakeholders.[30]

"We want to be as open and clear as possible about our environmental efforts – both our accomplishments and challenges – and share our experiences, ideas and thoughts as we work to integrate environmental responsibility into everything we do,” said Mary Wenzel, director of Environmental Affairs. “We also want to hear and learn from our customers. By working together, we can do even more to protect and preserve natural resources for future generations."

Recent controversies

Wells Fargo has been the target of activist actions because they are one of the largest investors into the GEO Group.[31] The GEO Group operates private prisons and immigrant detention facilities which have been criticized for serious abuses of detainees.[32][33]

In December 2005, the parachurch group Focus on the Family ended its banking relationship with Wells Fargo.[34] This was due to Wells Fargo's support of the gay rights movement when the company announced that it was matching contributions to GLAAD. Wells Fargo continued the program and received widespread support in the face of the boycott, which had no other high-profile participants.

Illinois Attorney General Lisa Madigan filed suit against Wells Fargo on July 31, 2009, alleging that the bank steers African Americans and Latinos into high-cost subprime loans. A Wells Fargo spokesman responded that "The policies, systems, and controls we have in place – including in Illinois – ensure race is not a factor..."[35]

In August 2010, Wells Fargo was fined by U.S. District Judge William Alsup for overdraft practices designed to "gouge" consumers and "profiteer" at their expense, and for misleading consumers about how the bank processed transactions and assessed overdraft fees.[36][37][38]

Wells Fargo corporate buildings

- Wells Fargo Center in Los Angeles, California

- Wells Fargo Place in Saint Paul, MN

- Wells Fargo Center in Minneapolis, MN

- Wells Fargo Center in Denver, CO

- Wells Fargo Center in West Des Moines, IA

- Wells Fargo Center in Austin, TX

- Wells Fargo Plaza in Houston, TX

- Wells Fargo Plaza in Phoenix, Arizona

- Wells Fargo Center in Portland, OR

- Wells Fargo Center in Salt Lake City, UT

- Wells Fargo Center in Sacramento, CA

- Wells Fargo Headquarters in San Francisco, CA

- Wells Fargo Advisors Headquarters in St. Louis, MO

- Wells Fargo Plaza in El Paso, TX

- Wells Fargo Plaza in Tacoma, WA

- Wells Fargo Center in Albuquerque, NM

- Wells Fargo Tower in Colorado Springs, CO

- Wells Fargo Center in Seattle, WA

- Wells Fargo Center in Boise, ID

- Wells Fargo Center in Spokane, WA

- One Wachovia Center in Charlotte, North Carolina

- Duke Energy Center (Formerly; Wachovia Corporate Center) in Charlotte - Wells Fargo owns and occupies space in the building[39]

- Wells Fargo Building in Milwaukee, WI

Wachovia headquarters - Charlotte, North Carolina, will succeed as Headquarters for East Coast Operations of Wells Fargo[39][40] |

Wells Fargo Center in Los Angeles |

Wells Fargo Center in Minneapolis |

Wells Fargo Center in Denver |

See also

- Stagecoach

- Butterfield Stage

- Pony Express

- Wells Fargo Center

- Wells Fargo Arena

- History of Wells Fargo

- List of Wells Fargo Directors

- List of Wells Fargo Presidents

- GEO Group Controversy

Notes

- ↑ 1.0 1.1 1.2 1.3 1.4 Rakesh R.S. Garia (2010-04-13). "FY2009 Annual Report". wellsfargo.com. WellsFargo. http://finance.yahoo.com/q/bs?s=WFC+Balance+Sheet&annual. Retrieved 2010-04-13.

- ↑ "Wells Fargo & Company: NYSE:WFC quotes & news - Google Finance". Google.com. http://www.google.com/finance?q=NYSE:WFC. Retrieved 2010-06-12.

- ↑ Browser Warning

- ↑ "S&P Downgrades Wells Fargo, U.S. Bancorp, Other Banks". BusinessWeek. 2009-06-17. http://www.businessweek.com/investor/content/jun2009/pi20090617_892748_page_2.htm. Retrieved 2009-07-29.

- ↑ "Wells Fargo and Wachovia Merger Completed". Wells Fargo. 2009-01-01. https://www.wellsfargo.com/press/2009/20090101_Wachovia_Merger. Retrieved 2009-01-01.

- ↑ Winkler, Rolfe (September 15, 2009). "Break Up the Big Banks". Reuters. http://blogs.reuters.com/rolfe-winkler/2009/09/15/break-up-the-big-banks/. Retrieved 17 December 2009.

- ↑ Tully, Shawn (February 27, 2009). "Will the banks survive?". Fortune Magazine/CNN Money. http://money.cnn.com/2009/02/27/news/economy/tully_banks.fortune/index.htm?source=yahoo_quote. Retrieved 17 December 2009.

- ↑ "Citigroup posts 4th straight loss; Merrill loss widens". USA Today. Associated Press. 2008-10-16. http://www.usatoday.com/money/companies/earnings/2008-10-16-citigroup_N.htm. Retrieved 17 December 2009.

- ↑ Winkler, Rolfe (August 21, 2009). "Big banks still hold regulators hostage". Reuters, via Forbes.com. http://www.forbes.com/feeds/afx/2009/08/21/afx6803343.html. Retrieved 17 December 2009.

- ↑ Temple, James; The Associated Press (November 18, 2008). "Bay Area job losses likely in Citigroup layoffs". The San Francisco Chronicle. http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/11/17/BURD146AIA.DTL. Retrieved 17 December 2009.

- ↑ Dash, Eric (August 23, 2007). "4 Major Banks Tap Fed for Financing". The New York Times. http://www.nytimes.com/2007/08/23/business/23discount.html. Retrieved 17 December 2009.

- ↑ Pender, Kathleen (November 25, 2008). "Citigroup gets a monetary lifeline from feds". The San Francisco Chronicle. http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/11/24/BUST14B71M.DTL. Retrieved 17 December 2009.

- ↑ Oman,Mark. "UBS Global Financial Services Conference." [PDF] Investor Presentation. San Francisco: Wells Fargo & Co., 11 May 2005. pp. 17, 23. Retrieved 7 November 2005.

- ↑ "Where We're Headed: Our Vision." Vision and Values.'.' Retrieved 26 October 2005.

- ↑ "How We Measure Success." Vision and Values.'.' Retrieved 26 October 2005.

- ↑ "Financial Review: Overview." 'Wells Fargo Annual Report 2004. [PDF] San Francisco: Wells Fargo & Co., 2005. p. 35. Retrieved 27 October 2005.

- ↑ https://www.wellsfargo.com/inatl/consumer_services/personal_banking

- ↑ Browser Warning

- ↑ https://www.wellsfargo.com/locator/atm/home Click "Wells Fargo In-Store Branches" for a pop-up with this information

- ↑ Wells Fargo agrees to buy Wachovia, Citi objects

- ↑ Citi: Wells Fargo blocked from buying Wachovia

- ↑ Court tilts Wachovia fight toward Wells Fargo

- ↑ Wells Fargo plans to buy Wachovia; Citi ends talks

- ↑ http://blog.wellsfargo.com/wachovia/2010/06/the_end_of_one_era_and_continu.html

- ↑ [1]

- ↑ Landler, Mark and Dash, Eric (October 14, 2008). "Drama Behind a $250 Billion Banking Deal". The New York Times (The New York Times Company). http://www.nytimes.com/2008/10/15/business/economy/15bailout.html. Retrieved 2009-02-04.

- ↑ https://www.wellsfargo.com/press/2009/20091223_tarp_repayment

- ↑ "Women's Shelter Names Wells Fargo Business of the Year". MarketWatch. 2010-04-15. http://www.marketwatch.com/story/womens-shelter-names-wells-fargo-business-of-the-year-2010-04-15?reflink=MW_news_stmp. Retrieved 2010-06-12.

- ↑ Money Economics Top 10 Banks Project

- ↑ "Wells Fargo Environmental Forum". Blog.wellsfargo.com. http://blog.wellsfargo.com/environment/index.html. Retrieved 2010-06-12.

- ↑ "Wells Fargo Attacked in Unincorporated Area of Santa Cruz". Indybay. http://www.indybay.org/newsitems/2008/09/28/18541764.php.

- ↑ Turnbull, Lornet (2008-07-16). "Report charges abuse of immigrant detainees at Tacoma center". Seattle Times. http://seattletimes.nwsource.com/html/localnews/2008053884_detention16m.html. Retrieved 2008-12-04.

- ↑ "Detention Center Study" (PDF). Seattle University School of Law. http://www.hatefreezone.org/downloads/Detention%20Center%20Study.pdf. Retrieved 2008-12-04.

- ↑ "Focus on the Family Severs Ties with Wells Fargo". Focus on the Family. December 1, 2005. Retrieved March 27, 2006.

- ↑ "Illinois Files Bias Suit Against Wells Fargo", Reuters, July 31, 2009]

- ↑ Gelles, Jeff (15 Aug. 2010). "Consumer 10.0: How Wells Fargo held up debit-card customers". The Philadelphia Inquirer. http://www.philly.com/inquirer/business/20100815_Consumer_10_0__How_Wells_Fargo_held_up_debit-card_customers.html.

- ↑ Numerian (12 Aug. 2010). "The checking account scam—How Wells Fargo gouged its customers". The Agonist. http://agonist.org/numerian/20100812/the_checking_account_scam_how_wells_fargo_gouged_its_customers. Retrieved Aug. 15, 2010.

- ↑ "Wells Fargo loses consumer case over overdraft fees". Los Angeles Times. 10 Aug. 2010. http://articles.latimes.com/2010/aug/10/business/la-fi-wells-20100810.

- ↑ 39.0 39.1 "Duke moves HQs to Wachovia tower - Charlotte Business Journal". Charlotte.bizjournals.com. http://charlotte.bizjournals.com/charlotte/stories/2009/02/23/daily43.html. Retrieved 2010-06-12.

- ↑ http://www.gastongazette.com/news/wachovia-26014-wells-fargo.html

References

- "Frequently Asked Questions." Wells Fargo History. URL accessed 26 October 2005.

- "Is there a way to look up relatives who may have worked as stagecoach drivers for Wells Fargo?" Wells Fargo History. URL accessed 26 October 2005.

- Mehta, Julie. "Merger means a bigger bank but uncertainty for employees." Cupertino Courier. 31 January 1996. URL accessed 26 October 2005.

- Segal, Dave. "Both CB Bancshares' Ronald Migita and Central Pacific's Clint Arnoldus have been through bruising bank battles before." Honolulu Star-Bulletin. 13 July 2003. URL accessed 26 October 2005.

- Svaldi, Aldo. "Wells Fargo learned hard way about deals." Denver Business Journal. 12 June 1998. URL accessed 26 October 2005.

- Vault.com. "Wells Fargo Company Profile." Excite Careers. 2000. URL accessed 26 October 2005.

- Baker, David R. "When hostile takeovers backfire." San Francisco Chronicle. 19 December 2004. p. C1. URL accessed 26 October 2005.

- In July 2007 Wells Fargo Insurance Services Inc.. was ranked fifth in Business Insurance's world's largest brokers list.

- "Wells Fargo Buying Placer Sierra Banks". cbs13.com. 2007-01-11. http://cbs13.com/local/Wells.Fargo.Placer.2.475105.html. Retrieved 2010-06-12.

- Said, Carolyn (2007-05-05). "Wells Fargo buys bank / Greater Bay has 41 branches in the Bay Area". Sfgate.com. http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2007/05/05/BUGU0PLI6H1.DTL. Retrieved 2010-06-12.

External links

Media related to Wells Fargo at Wikimedia Commons

Media related to Wells Fargo at Wikimedia Commons- Wells Fargo Home Page

|

|||||

|

|||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||